Being a parent can cost an arm and a leg. Just think of all the nappies, milk, and clothes that you have to buy let alone toys.

But one parent has explained a top tip to financially plan for your kid’s future. The bad news is that it starts immediately.

The dad called Brennan posted on his TikTok under the name of @budgetdog_ has a young daughter and opened up on the responsibilities of being a parent.

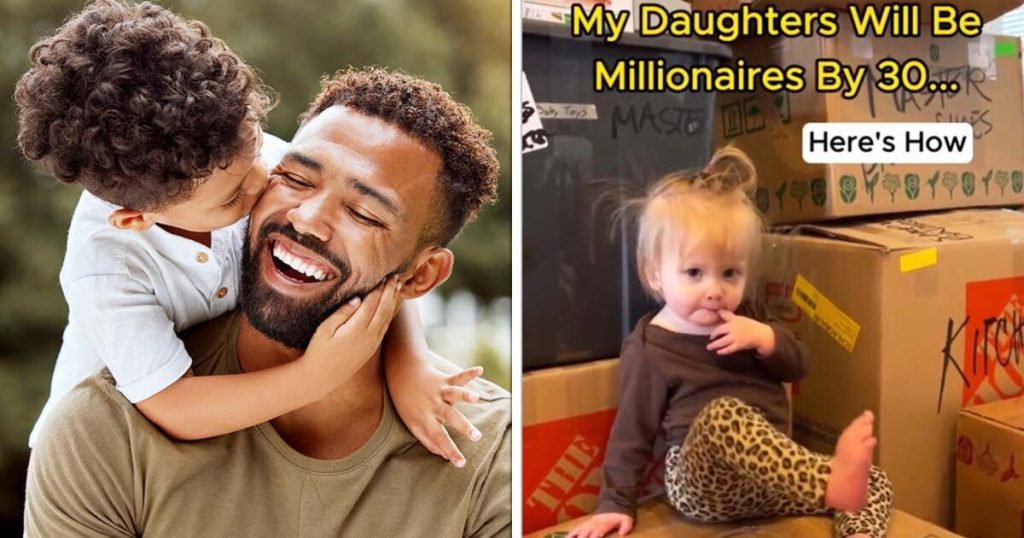

Despite his two young daughters being obvious to it all her dad claims they will be millionaires when they turn 30.

He claimed: “My daughters will be millionaires by 30.”

READ MORE: Kate’s parenting style may be ‘firmly against royal rules of the past’, expert claims

Brennan, who is from the US, shared his method with his 22,000 followers. He suggested putting $250 (£198.07) into a 529 plan which they would be able to use when they’re older for college. A 529 plan is a college savings plan sponsored by a state or state agency.

Another tip he gave was that he and his wife put the same amount into a taxable brokerage. Let’s not forget he was also his kids’ first employer.

He continued: “They get paid by BudgetDog LLC to be in reels like this. Fifty-dollars an hour goes to their Roth IRA.

“They’re learning about compound interest when they’re young. One dollar at their age is over $148 when they turn retirement age.”

This means the daughters will be reaping the benefits when they’re older.

“Ten thousand dollars one time gives them a $1.48 million retirement. It’s time to take control of our kids’ future.”

What is a 529 plan and a Roth IRA?

A 529 college savings plan is a tax-advantaged account that can be used to put toward education costs.

Meanwhile, a Roth IRA stands for Individual Retirement Account. This is where you can pay money into an account but it has no overall tax benefits.

However, despite the advice one person commented: “If only I had an extra $ at the end of the month after rent, groceries, car payment, etc.”